DSNews BY: Brian Honea December 14, 2015

Improving overall performance of first-lien mortgages means fewer delinquencies, and fewer delinquencies have in turn means a declining need for loss mitigation, according to the Office of the Comptroller of the Currency (OCC)’s Mortgage Metrics Report for the Third Quarter of 2015.

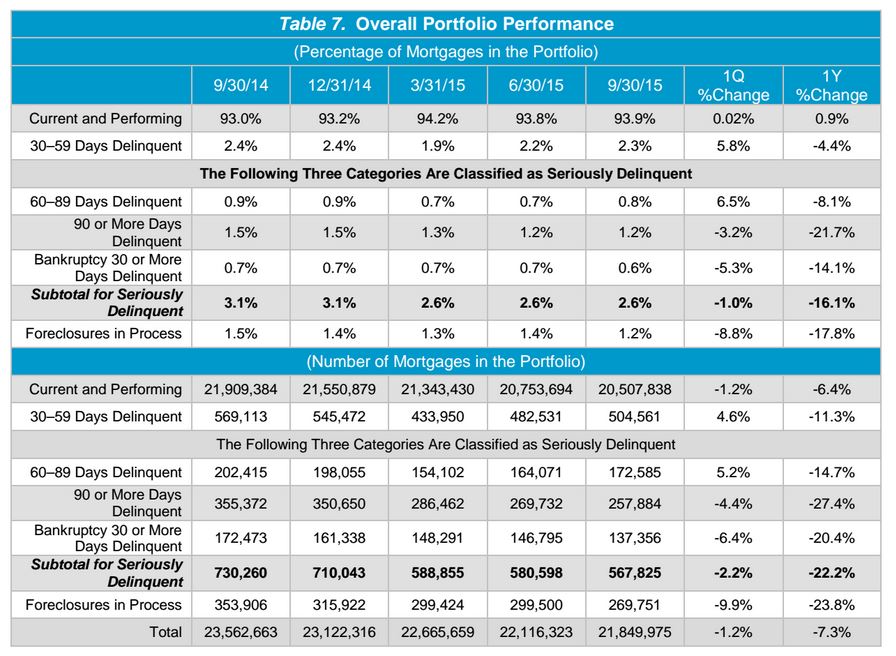

According to the OCC, 93.9 percent of outstanding residential mortgages serviced by eight national banks (Bank of America, JPMorgan Chase, Citibank, HSBC, OneWest Bank, PNC, U.S. Bank, and Wells Fargo) were current and performing as of the end of Q3 2015—an improvement of nearly a full percentage point from the previous quarter a year ago, when 93.0 percent of mortgages for the eight banks were reported to be current and performing. The 93.9 percent of performing mortgages computes to approximately 20.5 million of the 21.8 million mortgages covered in the portfolio.

A larger share of current and performing first-lien mortgages has corresponded with a smaller share of the “negative” mortgage metrics such as serious delinquencies, foreclosure starts, and foreclosure inventory, according to the OCC. Serious delinquencies, which are defined as 60 or more days overdue or held bankrupt by borrowers whose payments are 30 or more days overdue, comprised about 2.6 percent of the portfolio (about 172,000 mortgages) as of the end of Q3, which is a 16 percent drop from the end of Q3 2014.

The number of new foreclosures initiated declined year-over-year in the third quarter of 2015, from 83,000 to about 64,000, while the number of homes in the process of foreclosure declined by nearly one-quarter (23.8 percent) down to about 270,000 homes. This number represented about 1.2 percent of mortgages in the portfolio; according to the OCC, “Improved economic conditions and foreclosure prevention assistance contributed to the decline in foreclosure activity.”

The need for loss mitigation services has declined as mortgage performances have improved, according to the OCC’s report. In the third quarter of 2015, servicers implemented 147,543 home retention actions, which was about 28 percent fewer than a year earlier. Those actions included modifications, trial-period plans, and shorter-term payment plans, and nearly 88 percent of the home retention actions implemented during the quarter reduced the borrower’s monthly principal and interest payments. According to the OCC, borrowers reduced their monthly payment by an average of $243 with home retention actions implemented during Q3; more than half of those actions (53 percent) resulted in a payment reduction of more than 20 percent.

The need for loss mitigation services has declined as mortgage performances have improved, according to the OCC’s report. In the third quarter of 2015, servicers implemented 147,543 home retention actions, which was about 28 percent fewer than a year earlier. Those actions included modifications, trial-period plans, and shorter-term payment plans, and nearly 88 percent of the home retention actions implemented during the quarter reduced the borrower’s monthly principal and interest payments. According to the OCC, borrowers reduced their monthly payment by an average of $243 with home retention actions implemented during Q3; more than half of those actions (53 percent) resulted in a payment reduction of more than 20 percent.

Out of the 3.8 million modifications servicers implemented from January 1, 2008, to June 30, 2015 covered in the portfolio, about half (51 percent, or 1.92 million) were active as of the end of Q3 2015, according to the OCC. The remaining 49 percent exited the portfolio through a variety of means—payment in full, involuntary liquidation, or transferring to a non-reporting servicer. Out of those 1.92 million modifications as of the end of Q3 2015, 71.2 percent were current and performing; 23.6 percent were delinquent; and 5.2 percent were in the process of foreclosure.

The OCC’s report covers about the performances of 21.8 million outstanding mortgages nationwide, which computes to about 42 percent of all residential mortgages through September 30, 2015. The mortgages in the portfolio cover about $3.7 trillion in principal balances. To view the complete report, click here.